金價:憂疫情影響全球經濟,紐約期金與現貨金上週五各大漲1.75%、1.47%.累計上週黃金期貨價格上揚3.93%,創去年6月來最佳週度表現;黃金現貨價格週線上漲3.75%,為去年8月來最大週度上揚。

OANDA高級市場分析師Edward Moya表示,市場再次感到焦慮,因疫情可能在中國以外擴散。隨著中國、日本和德國經濟放緩料將在上半年持續,市場出現龐大的避險需求。對各國央行將全面推出刺激舉措的預期相當高,這將繼續推高金價。

《Gold Newsletter》編輯 Brien Lundin 表示,黃金市場現在是大混戰,各種避險和投機交錯,由於武漢肺炎病毒激起不確定性,全球資金尋覓安全標的,因投資人預期無論經濟衝擊程度高低,央行必然出手。

Brien Lundin 說道:「因此,至少就目前看來,恐懼和貪婪結合起來推動黃金市場走高。」

Brien Lundin 估計明年年底前,黃金價格可刷下 2000 美元紀錄,這樣的時間點「可以讓市場免於過熱,也讓投資者有更多時間在礦業股上賺錢,礦業股通常利用黃金走勢來進行槓桿。」

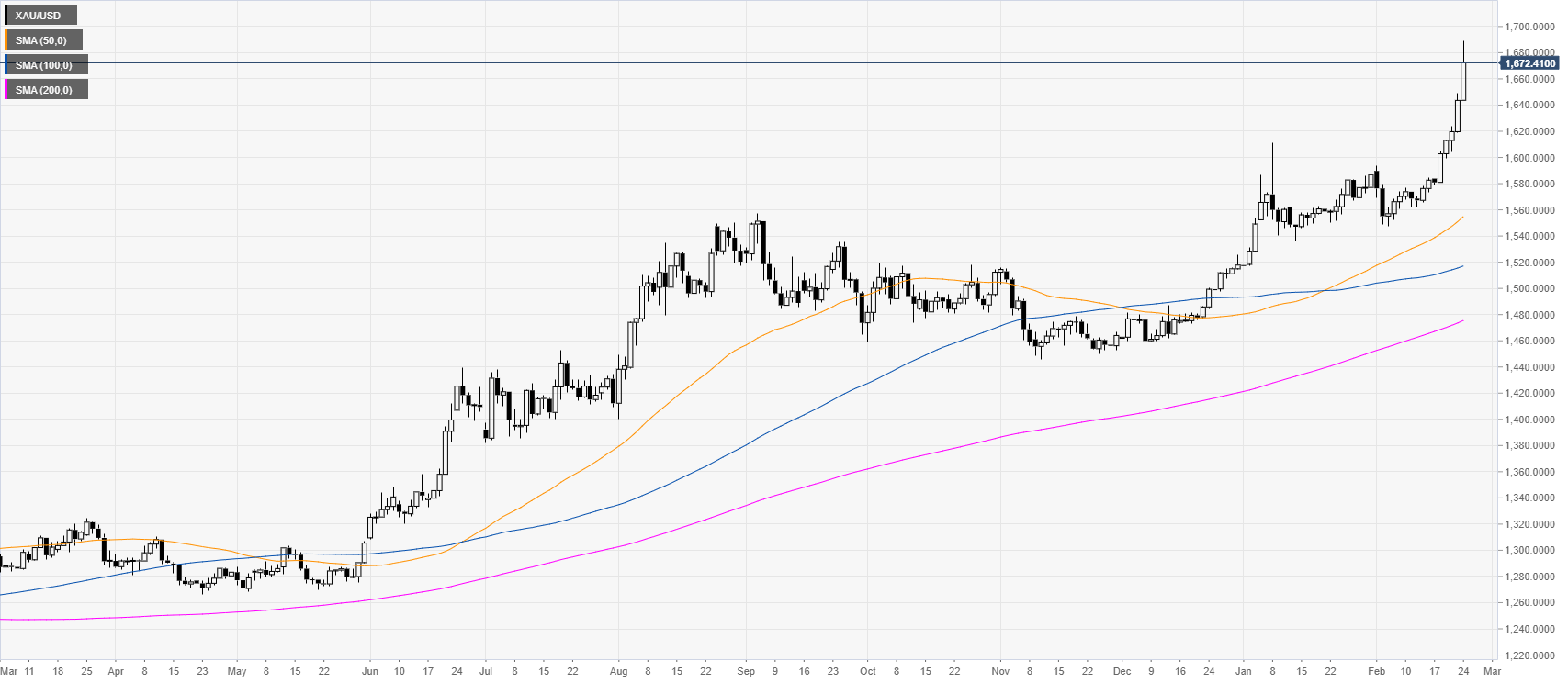

Gold Price Analysis: XAU/USD trading in seven-year’s high, nearing $1700/oz

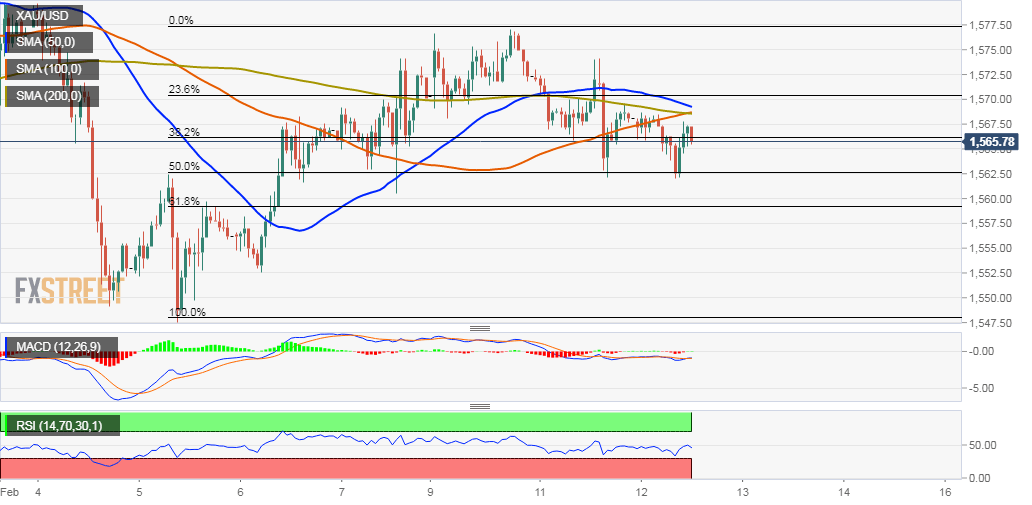

Gold Price Analysis: Rebounds from weekly lows, lacks follow-through.

Gold once again manages to find some suport near the $1562 region.

- Mixed technical set-up warrants some caution for aggressive traders.

Gold quickly reversed an early dip to weekly lows and is currently placed near the top end of its daily trading range, around the $1566 region.

The intraday downtick attracted some buying near the $1662 region, which coincides with 50% Fibonacci level of the $1548-$1577 recent positive move.

The mentioned support should now act as a key pivotal point for short-term traders and help determine the next leg of a directional move for the commodity.

Meanwhile, technical indicators on hourly charts have again started gaining negative traction and support prospects for a further near-term depreciating move.

黃金現貨價20200224 日上漲 0.73% 至 1,658.02 美元,盤中最高升至 1,689.29 美元,創 2013 年 1 月 23 日以來新高。

Gold Price Analysis: XAU/USD trading in seven-year’s high, nearing $1700/oz.

留言列表

留言列表